how much tax is taken out of my first paycheck

In 2022 the federal income tax rate tops out at 37. You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck.

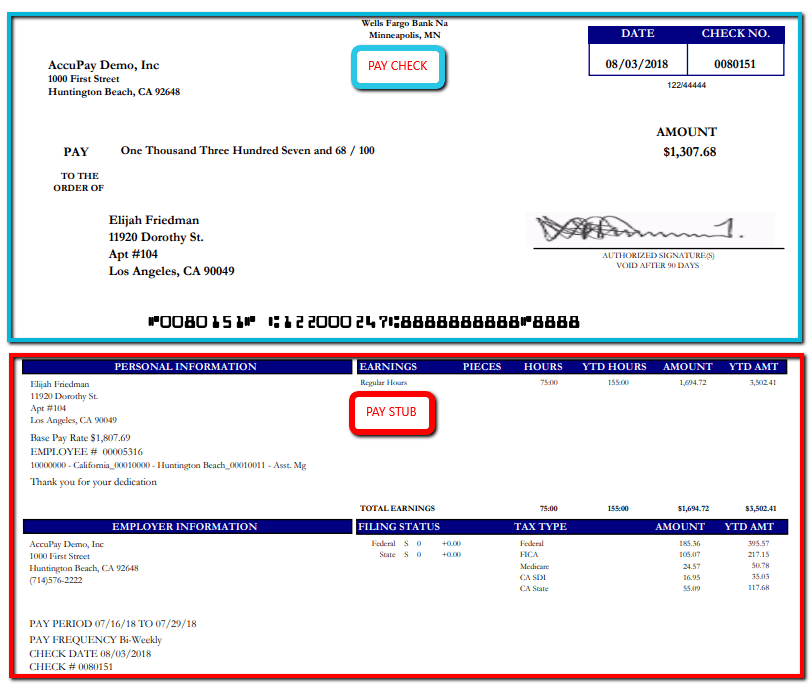

Understanding A Paycheck And Pay Stub Quiz Quizizz

What Amount Of Taxes Get Taken From Yes Are Taken Out Of My Paycheck.

. The more someone makes the more their income will be taxed as a percentage. If you have too much tax taken out of your paycheck you will receive a refund but in the meantime youre giving the. For a single filer the first 9875 you earn is taxed at 10.

The IRS offers a withholding calculator so taxpayers can ensure they have the correct amount of tax taken out of their paychecks. When you were first hired you filled out a W-4 form and claimed the number of tax exemptions you have. How much taxes do you pay on 1000.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Your taxable pay equals 64616. Helping business owners for over 15 years.

This amount tells the federal government how much money to take out of each paycheck to cover your taxesThe more allowances you take the less federal income tax the government will take out of your paycheck. It also varies based on the number of withholding. For example in 2018 suppose you were single and earning 9000 per year.

In 2021 you must contribute 2 of your salary to Social Security which is 142800 and in 2023 you will contribute 1 of your salary. The calculation for these deductions is pretty straightforward. A total of 1243 million people receive Social Security.

Your employer does not match this surtax. There is a 3 tax on employees gross taxable income. 1116 on portion of taxable income over 90287 up-to 150000.

Health care system pays 4 of its income and Medicare pays 2. If too much tax is being taken from your paycheck decrease the withholding on your W-4. Only the highest earners are subject to this percentage.

What percent of taxes are taken from your paycheck. How do I change my withholding to less on my w4. Total Amount of salary 200.

The amount withheld for income tax is determined by information on the employees W-4 form. The amount your employer deducts from your check for federal income tax is based on your filing status and the amount of money you make. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Taxes are calculated from a paycheck.

The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. In addition to Social Security and Medicare withholding FICA is also known as Federal Insurance Contributions Act. Tax on the first 44 is zero.

However they dont include all taxes related to payroll. The government uses federal tax money to help the growth of the country and maintain its upkeep. If you earn wages in excess of 200000 single filers 250000 joint filers or 125000 married people filing separately you have to pay a 09 Medicare surtax.

How much tax is deducted from a 1000 paycheck. The other deductions in her paycheck are more straightforward. For example if you earn 200 per month and you are deducted 32 your tax in percentage will be as follows.

What percentage of my paycheck is withheld for federal tax 2021. Most workers have money for taxes taken out of their paycheck including federal income tax and taxes for Social Security and Medicare. The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount.

Taxes on income over 180001 are 45. The amount of FICA tax is 153 of the employees gross pay. If too little is being taken increase the withheld amount.

Taxes on payroll are imposed at 15 percent. 505 on the first 45142 of taxable income. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

915 on portion of taxable income over 45142 up-to 90287. Medicare taxes account for a smaller percentage at 145 with employers again matching that amount. To adjust your withholding is a pretty simple process.

Those who earn 18200 within a single tax year are exempt. The amount your employer deducts from your check for federal income tax is based on your filing status and the amount of money you make. Under the Before Tax Adjustments section enter any qualifying 401k percentage or HSA contribution amounts that are being withheld from your paycheck.

Employer and employee taxes are equally split but employee taxes are reduced by 9. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Employer know how much money to withhold from your paycheck for federal income taxes.

Half of the total 765 is withheld from the employees paycheck and half is paid by the employer. These amounts are paid by both employees and employers. Next youll pay 19 on earnings between 18201 and 45000.

Under the After Tax Adjustments section select your state or enter your state income tax rate enter any after-tax deductions health insurance premiums dental plan premiums etc and enter an employer. So if your daughter will have a taxable income of 30000 the first 8700 would be taxed at 10 percent and the remaining 21300 would be taxed at 15 percent under the 2012 tax rate schedule. The percentage of federal income tax taken out of taxable wages starts at zero and increases in a series of steps called tax brackets to a maximum of 396 percent.

What is 1200 after taxes. FICA taxes consist of Social Security and Medicare taxes. These are contributions that you make before any taxes are withheld from your paycheck.

FICA taxes are commonly called the payroll tax. I charge you 6 per month. You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck.

From 45001 to 120000 earnings ranged from 5 to 37. How much tax is taken off a paycheck in Ontario. The next bracket from 8701 to 35350 is taxed at a 15 percent tax rate.

You can simply calculate the percentage tax deducted from your pay by multiplying the total amount of tax deductions by a hundred and then dividing by your salary. Federal Income Taxes. You need to submit a new W-4 to your employer giving the new amounts to be withheld.

For example in 2018 suppose you were single and earning 9000 per year. Suppose you are single claim two withholding allowances and make 800 per week. How much is 15 an hour for 8 hours.

How do I calculate how much tax is taken out of my paycheck. This amount depends on allowances for things such as your marital status because married and unmarried people pay different amounts of taxes or if you have dependent children.

Understanding What S On Your Paycheck Xcelhr

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

Line Haul Darat Jakarta The Ultimate Revelation Of Line Haul Darat Jakarta Revelation Haul Jakarta

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Taxes Federal State Local Withholding H R Block

Themint Org Tips For Teens Decoding Your Paycheck

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Why I Use The 50 30 20 Formula Budgeting Money Personal Finance Budgeting Finances

How To Read Your Paycheck Arkansas Next

As A Teenage Independent Contractor I Got My Savings Wiped Out With My First Ta Personal Finance Bloggers Personal Finance Lessons Personal Finance Printables

Different Types Of Payroll Deductions Gusto

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief